TDS Return Filing

Entities having TAN Registration must file the TDS returns. TDS returns are due quarterly. We can help you with e-filing your TDS returns online. Our TDS experts will help you with computation, TDS payments and filing of the TDS return and keep you in compliance with TDS regulations across India at a very affordable price through 100% online process.

What is TDS ?

Tax Deducted at Source (TDS) is an indirect system of collection of tax.

As per Income Tax Act, 1961, any company or person making a payment of any service like salary, commission payment, consultancy charges, service charges, subcontract charges etc. shall deduct an amount towards TDS and pay it to the credit of Central Government. The deducted tax amount should be deposit to the Income Tax department by the company or deductor on behalf of the payee. Further, this TDS amount can be adjusted with the payable income tax of the payee at the time of ITR filing only if the deductor has filed the TDS return.

For example; XYZ private limited makes a payment of Rs 100,000 towards professional fees to Mr ABC, then XYZ Private Limited shall deduct a tax @10% of Rs 10,000 and make a net payment of Rs 90,000 to Mr ABC. The amount of 10,000/- deducted by XYZ Private Limited will be directly deposited to the credit of the Government towards TDS.

For non-deduction of TDS of Rs 10,000, the expense of Rs 100,000 lakhs shall be disallowed. This means that your spending increases with the same amount that in turn will raise your tax burden with Rs. 25000.

What is TDS Payment ?

Every person or entity who deducted TDS, required to pay the deducted tax to the Income Tax department in challan 281 by the 7th day of the following month. Late payment or non-payment of TDS will attract interest @ 1.5% per month till the tax has been deposited.

What is TDS Return ?

Apart from the deduction and deposit of TDS, A TDS return should be submitted by tax Deductor for every quarter with the Income Tax Department. TDS return is a statement that requires the details of the tax collected, source of collection and tax paid to Government for the reporting time.

Generally, tax is deducted on transactions such as Salaries, commission, professional fee, contractual payments, payment of rents exceeding a certain amount, etc. For every such type of transaction and payment, there is a prescribed rate of interest. The deductee can claim the benefit of the tax deducted while ITR filing, only if the deductor has filed the TDS return on time. Non-filing or late filing of TDS return will attract the penalty of Rs 200 per day till the return has been filed.

Skip Travel !

Consult with Experts now : +91-9319-266-200

Important Dates for TDS Payment and Return Filing

TDS Payment (April - Feb)

Before 7th of Next month

TDS Return (July-Sep) Q2

31st October

TDS Payment (March)

30th April

TDS Return (Oct-Dec) Q3

31st January

TDS Return (April - June) Q1

31st July

TDS Return (Jan-Mar) Q4

30th April

Skip Travel !

Consult with Experts now : +91-9319-266-200

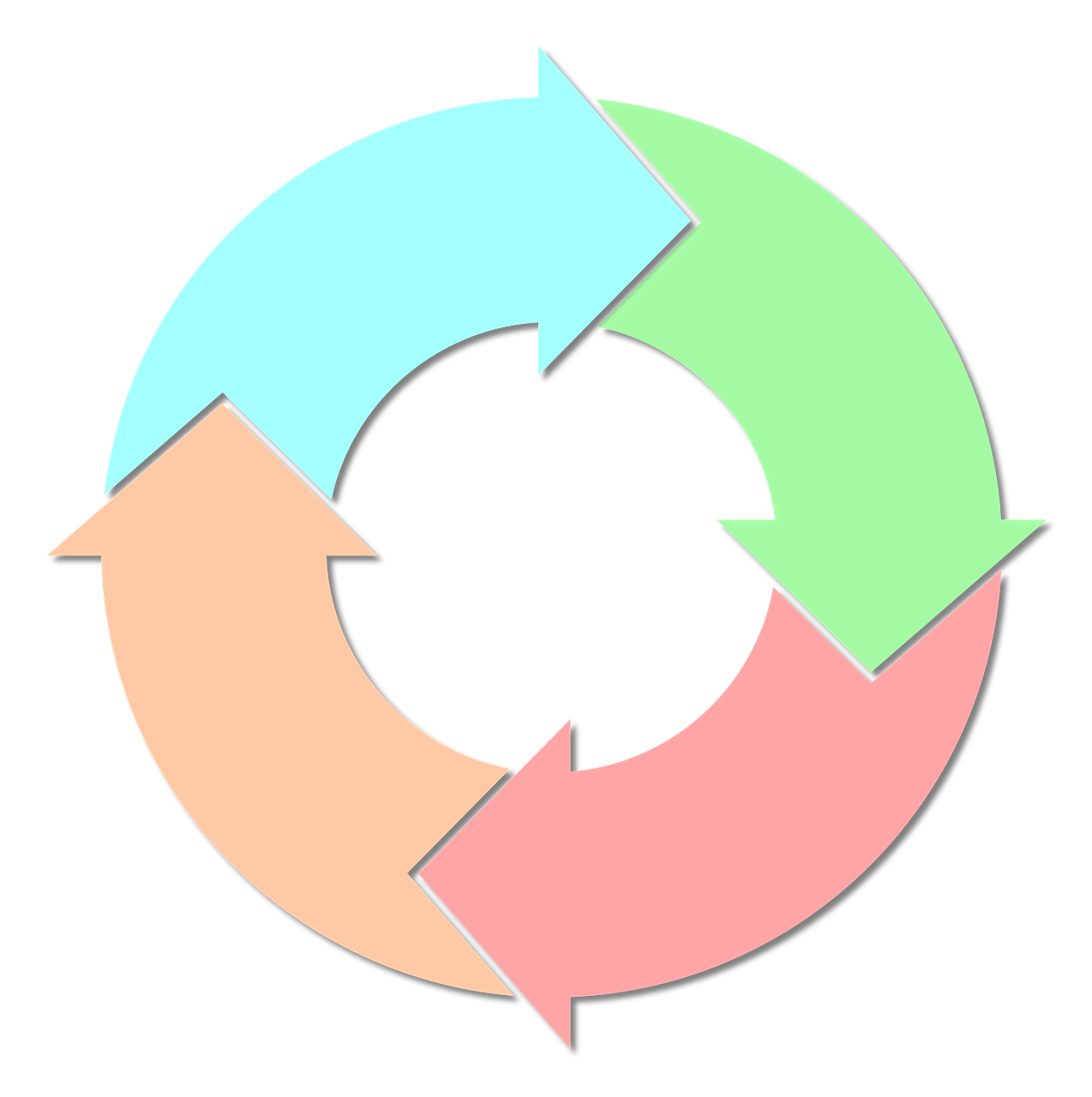

Process of TDS

- 1. Render Services

- 2. Make the payment after deducting TDS with the applicable rate

- 3. Payment of TDS to the Income Tax department in challan 281 online

- 4. Collection & Reconciliation of the information of deductee

- 5. Preparation and filing of TDS return in 26Q and 24Q.

- 6. Deductor Issues Form 16A to deductee for the TDS amount deducted.

- 7. Deductee files Income Tax return. If no income tax liability, TDS will be refunded and if there is tax liability TDS is reduced from income tax liability.

Skip Travel !

Consult with Experts now : +91-9319-266-200

What our clients have to say

We take pride! Not in our execution, But in your words. Here’s what keeps us going strong.

Had an outstanding experience working with RPG Legal to set up my company & Trademark Registration. Even minute details were explained and all aspects provided. Ready to support beyond hours, hat’s off guys. Special thanks to Ms Preet & Simran to assist us in stepping by step procedure and updating me on every stage.

D D Yadav

Director, Rosemoon Healthcare Private Limited

It was a very immeasurable experience in setting up my company. The team are professional & understands the need and executes at the pace needed. I really appreciate & recommend.

Prashant Singh

Director, ShiftPurple & Nextdot

Dedicated, supportive and understanding team…

What else do we need to get the jobs done? Thanks to RPG Legal for helping us. And I hope this will be maintained as you already established a great business relationship. Cheers.!!

Vaibhav Vishal Srivastava

Director, Certslearning Private Limited

Highly supporting system for new business.. Thank you RPG Legal for providing every type of business-related support to new in the field like me… and want to really appreciate the work of “Mr Anand” who provides us helpful advice each and every time related to our business.

Sumit Ghugharwal

Director, Ghugharmedia Private Limited

We’re using your services form the last three years. We are delighted with the way solutions are provided in matters we have endeavoured professional help. We admire the association and look forward to a similar experience in the years ahead.

Saajib Zaman

Founder, Proict LLC

We started with a Private Limited company incorporation for our Educational Institute. We have been taking the services from last two years and had an amazing service experience with the team. Smooth work everything was completed on time with perfection.

Apoorva Bhargav

Co-Founder, EDEN IAS